Since our foundation in 2011, we have endeavoured to manage our company as inclusively as possible. This means handing over as much responsibility as possible, promoting bottom-up initiatives, demanding a shared vision and making processes and information transparent. I think that after 13 years, we have succeeded in doing this step by step – except for one thing: ownership. So it's high time we tackled this issue.

Actually ...

... we are burnt children! In 2017/2018, we went through a crisis that caused, among other things, disagreements among the five partners who owned the company at the time. Or perhaps the aforementioned disagreements caused a crisis. Anyways – the fact is that we went from five partners to three during this time and agreed upon never to take on any new partners. Did I mention that you should never say never?

Individual onboardings failed

In 2022, a good five years later, we regained our confidence: We wanted to gain two long-standing employees as partners. Our motivation behind this was obvious: our capital, especially as an agency, is our employees. If we can involve key persons, this strengthens customer relationships and the business. Plus: It is a pleasure to retain employees who have become friends. We also thought about how employees can continue to grow in a smaller company when they are already at the top – i.e. senior.

Unfortunately, the plan failed and even led to a cancellation. What happened?

- The specific request to become a partner triggers many things. Among other things, it triggers reflection on where the personal journey should take us in the next few years. And so one person's latent desire to change sectors completely suddenly materialised.

- We had linked our enquiry to a minimum investment. This is not easy to manage financially and competes with other interests, such as home ownership.

- The minimum participation was linked to expectations regarding commitment (e.g. evening or weekend availability/work).

- A smaller participation does not seem very exciting if you are the only person in the minority (compared to three others).

Our plan had to be buried for the time being and other ideas had to be found.

The idea of the co-operative

I have been involved in associations for a long time and I am impressed by how well associations can survive for decades: Everyone is involved, bears responsibility, is (more or less) equally involved in the association and changes in leadership usually occur naturally. So why not take inspiration from this and transform our public limited company into a co-operative? There are some very exciting examples in this area (I found this podcast by ‘walder partner’ very inspiring). After some research and interviews with people, I rejected the idea because I didn't think it was financially realistic and I wasn't personally prepared to give up a majority stake.

Real shares

The employee programme turned out to be the ideal solution for us between a co-operative and a minimum shareholding: On the one hand, low-threshold participation is possible and as many employees as possible can participate. On the other hand, the programme should be open to everyone (not by invitation only). Participation is based on real shares with all the trimmings. We deliberately decided against options, participation certificates or phantom stock options (and all the other things that the beautiful start-up world conjures up) because we like honest (or real) things it suits our use case best (we are not pursuing an exit).

The concrete design

In practice, we define a minimum buy-in of CHF 20,000 and the seller is always the company itself. In the event of an exit from Renuo – whether voluntary or involuntary – it has a right of first refusal before the other shareholders. In order to make room for other possible opportunities (e.g. residential property) – and to a certain extent as a protective clause – we built in a two-year buy-back right at the same price. In this case, any gains or losses are borne by Renuo AG.

The purchase and sale prices are determined by a formula valuation consisting of 1xsales plus 1xcapital. We found this formula appropriate because it was rather below the tax valuation (KS28): employees get a good price, so to speak, and we give nothing away for free. Furthermore, it was roughly an average of various valuation models such as the practitioner method, DCF, sales multiple or EBITDA multiple. There is one time window per year for transactions, namely after the audit (when the turnover and capital are confirmed).

Being a shareholder does not entail any further obligations such as increased demands on availability or pressure to sell. Instead, it is primarily ‘only’ a financial matter.

Lurking legal pitfalls

As all employees can participate, the risk of unwanted effects on taxes and social security increases: On the buyer's side, prices that are too low would be categorised as a salary component and result in social security contributions and income taxes. On the seller's side, it could be classed as a debt waiver and an indirect reorganisation measure, which in turn could result in issue levies with withholding tax consequences. Excessively high prices, on the other hand, could be considered a hidden profit withdrawl. Pitfalls – wherever you look! – and the moment for us to seek legal advice.

Together with a tax law expert, we drafted a so-called ruling, which we had approved by the Canton of Zurich. In it, we formulated all the processes and had it confirmed that this would not have any unintended consequences. And thanks to Switzerland's federalist system, we did the same with the cantons of St.Gallen and Appenzell Ausserrhoden (all the cantons involved).

What happens next?

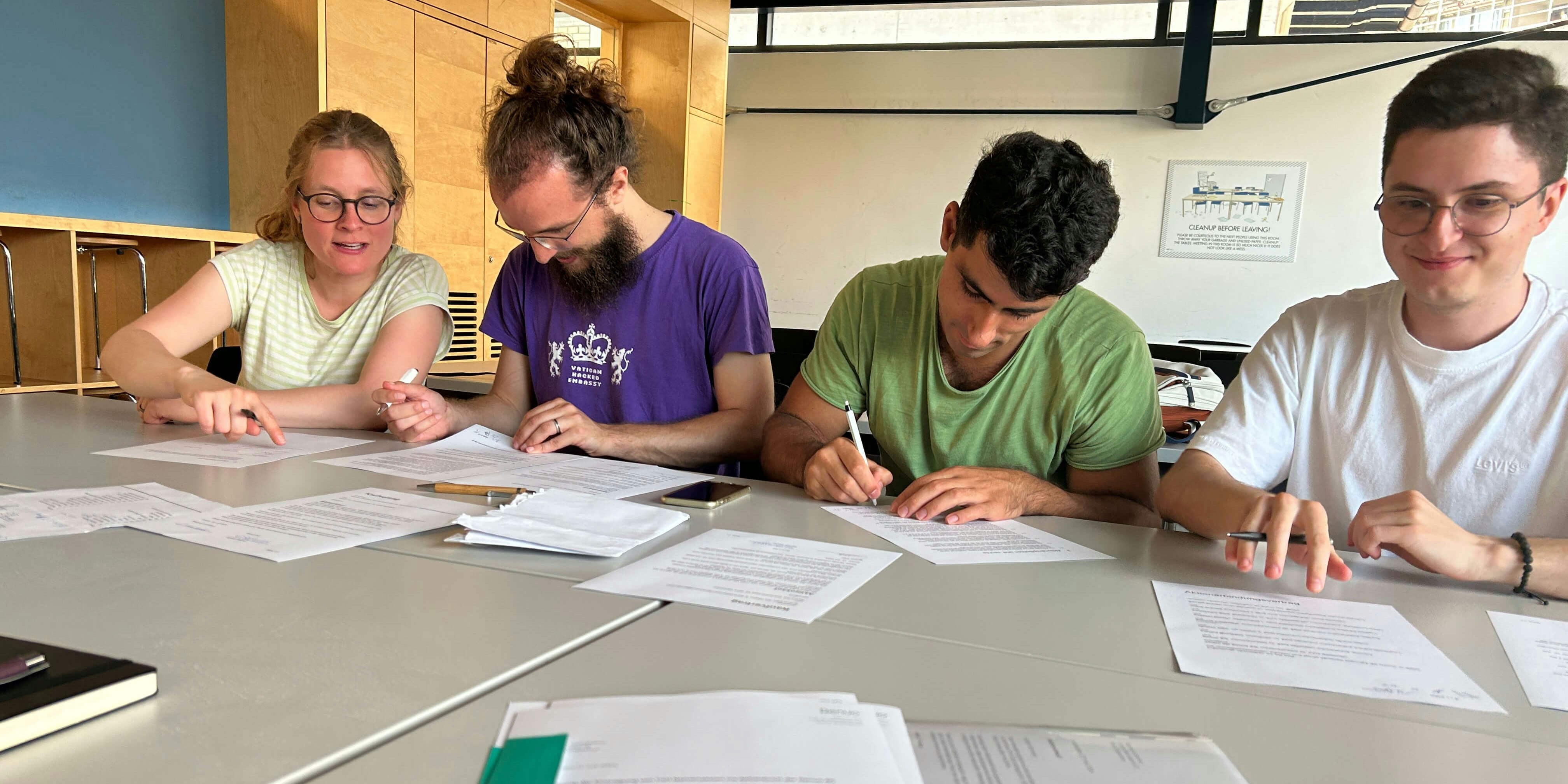

So far, four employees have joined as partners. The expansion of our ownership is a logical continuation of our mission: we unite committed, motivated and well-trained people to achieve great things together. The integration also emphasises our long-term commitment to our relationships and therefore to ourselves: We have come to stay. Now even more sustainable. We are excited.